So, you're thinking about ordering a checkbook from Chase, huh? Well, you're in the right place. Whether you're new to managing your finances or just looking for a refresher, this guide's got you covered. Ordering a checkbook might seem like a simple task, but trust me, there's more to it than meets the eye. Let's dive into everything you need to know to make sure you're doing it right.

Let's be honest, in this day and age, checkbooks might feel a bit old-school. But hey, they're still super useful for certain transactions. From paying rent to settling those pesky IOUs, having a checkbook can save you a ton of hassle. Plus, it's always good to have a backup plan when digital payments don't quite cut it.

Now, before we get into the nitty-gritty, let's talk about why Chase is such a big deal. With millions of customers and a reputation for reliability, Chase is one of the top banking choices in the U.S. So, if you're already a Chase customer, ordering a checkbook is just another way to make the most out of your account. Ready to learn more? Let's go!

Read also:Keith Lemon Actor The Rising Star Whorsquos Making Waves In The Entertainment World

What You Need to Know About Order Checkbook Chase

Why Chase Is Your Go-To Bank

First things first, let's break down why Chase is such a solid choice for your banking needs. Chase offers a wide range of services, from checking and savings accounts to credit cards and loans. And when it comes to ordering a checkbook, Chase makes the process smooth and straightforward. Plus, with their mobile app and online banking options, you can manage your finances from anywhere, anytime.

Here's a quick list of what makes Chase stand out:

- 24/7 customer support

- Thousands of ATMs nationwide

- User-friendly mobile app

- Wide selection of account options

How to Order Checkbook Chase: Step-by-Step Guide

Step 1: Log In to Your Chase Account

The first step in ordering a checkbook from Chase is logging into your account. You can do this either through the Chase website or their mobile app. Make sure you're using a secure connection, especially if you're accessing your account on a public Wi-Fi network. Once you're logged in, head over to the "Order Checks" section.

Step 2: Choose Your Checkbook Design

Now, here's where things get fun. Chase offers a variety of checkbook designs to suit your personal style. From classic and professional to funky and colorful, there's something for everyone. Take your time browsing through the options, and don't be afraid to go with something that reflects your personality. After all, why not make writing checks a little more enjoyable?

Step 3: Customize Your Checkbook

Once you've picked out a design, it's time to customize your checkbook. You can add your name, address, and phone number to each check, making it easier for recipients to contact you if needed. You can also choose the number of checks you want in your book, depending on how often you plan to use them.

Understanding the Costs Involved

Are There Fees for Ordering a Checkbook?

One of the most common questions people have about ordering a checkbook is whether there are any fees involved. The good news is that Chase doesn't charge a fee for ordering your first checkbook. However, if you need to order additional checkbooks in the future, there may be a small fee. It's always a good idea to check with Chase directly to get the latest information on fees and charges.

Read also:Aries Adventure Exploring The Bold And Unstoppable Spirit Of Aries

Benefits of Using a Checkbook

Why Checks Are Still Relevant

Even in today's digital world, checks still have their place. They're a great option for situations where cash or digital payments aren't practical. For example, if you're renting a property or making a large purchase, a check can provide a secure and reliable way to transfer funds. Plus, checks offer a paper trail, which can be helpful if you ever need to dispute a transaction.

Tips for Managing Your Checkbook

Keep Track of Your Transactions

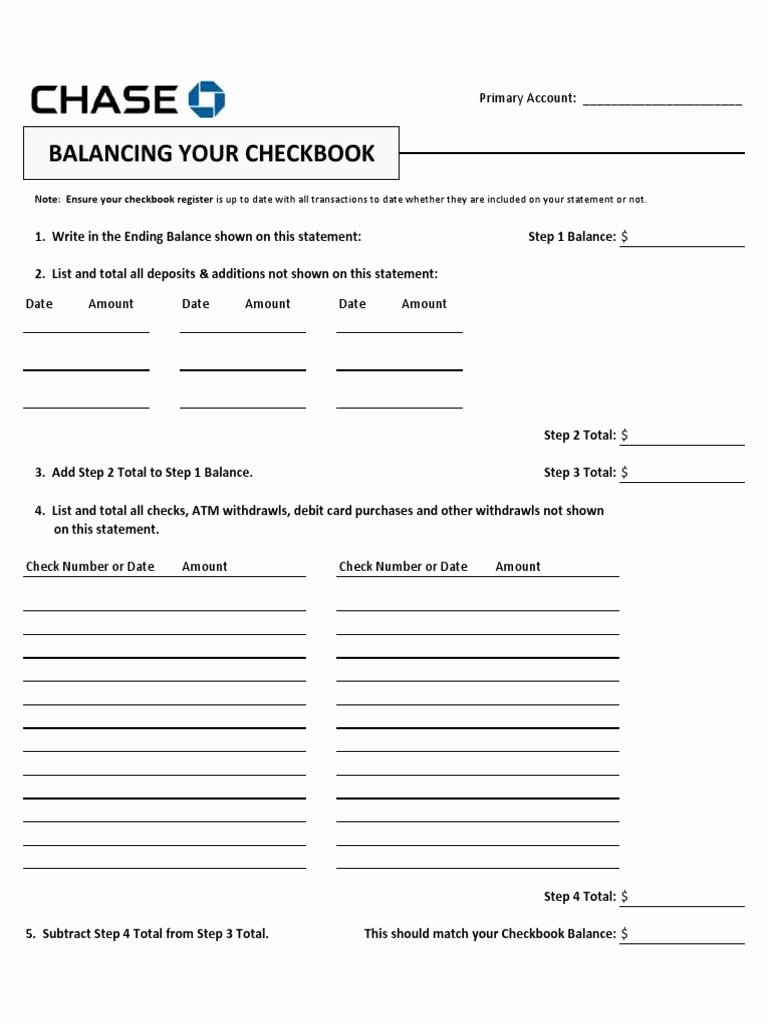

One of the keys to successful checkbook management is keeping track of your transactions. Make sure to record every check you write in your check register, including the date, payee, and amount. This will help you stay on top of your finances and avoid any unpleasant surprises when your bank statement arrives.

Reconcile Your Account Regularly

Another important tip is to reconcile your account regularly. This means comparing your check register to your bank statement to ensure everything matches up. If you notice any discrepancies, contact Chase customer service right away to resolve the issue.

Common Questions About Order Checkbook Chase

How Long Does It Take to Receive My Checkbook?

After you place your order, it typically takes 7-10 business days for your checkbook to arrive. However, this can vary depending on your location and the shipping method you choose. If you haven't received your checkbook after two weeks, don't hesitate to reach out to Chase customer service for assistance.

Can I Cancel My Checkbook Order?

Yes, you can cancel your checkbook order if you change your mind. Simply contact Chase customer service and provide them with your order details. They'll be able to assist you in canceling your order and refunding any applicable fees.

Security Measures for Your Checkbook

Protecting Your Personal Information

When it comes to checkbook security, there are a few things you can do to protect your personal information. First, always store your checkbook in a safe and secure location. Second, be cautious about sharing your account information with others. And finally, if you suspect any fraudulent activity, report it to Chase immediately.

Conclusion: Take Control of Your Finances

Ordering a checkbook from Chase is a simple and effective way to manage your finances. Whether you're using checks for personal or business purposes, having a checkbook on hand can make life a lot easier. By following the steps outlined in this guide, you'll be well on your way to mastering the art of checkbook management.

So, what are you waiting for? Head over to your Chase account and place your order today. And don't forget to leave a comment below if you have any questions or tips of your own. Sharing is caring, after all!

Table of Contents

- What You Need to Know About Order Checkbook Chase

- How to Order Checkbook Chase: Step-by-Step Guide

- Understanding the Costs Involved

- Benefits of Using a Checkbook

- Tips for Managing Your Checkbook

- Common Questions About Order Checkbook Chase

- Security Measures for Your Checkbook

- Conclusion: Take Control of Your Finances