Alright folks, let’s dive straight into the world of czech swaps. If you’ve ever scratched your head wondering what these swaps are all about, you’re in the right place. Czech swaps have been making waves in the financial world, and they’re not just some random buzzword. These swaps are a game-changer, and we’re here to break it down for you in a way that’s easy to understand. So, buckle up, because we’re about to take you on a wild ride through the ins and outs of czech swaps.

Now, let’s face it, the financial world can be a bit intimidating. All those fancy terms and complicated jargon can leave even the savviest investor feeling a little lost. But here’s the thing, czech swaps are actually pretty straightforward once you get the hang of them. They’re like the secret sauce that can spice up your investment portfolio and give you an edge in the market.

So, whether you’re a seasoned pro or just starting out, understanding czech swaps is crucial. In this article, we’ll cover everything you need to know, from the basics to the more advanced strategies. By the time you’re done reading, you’ll be armed with the knowledge to make informed decisions and potentially boost your financial success.

Read also:Is Lilith Berry Ai Unveiling The Truth Behind The Digital Phenomenon

Let’s get started with a quick overview of what you’ll find in this article. We’ve got a lot of ground to cover, so here’s a handy table of contents to help you navigate:

- What Are Czech Swaps?

- History of Czech Swaps

- How Czech Swaps Work

- Types of Czech Swaps

- Benefits of Czech Swaps

- Risks and Challenges

- Czech Swaps in Action

- Legal and Regulatory Aspects

- Expert Tips for Success

- Conclusion

What Are Czech Swaps?

Alright, let’s start with the basics. So, what exactly are czech swaps? Well, in simple terms, czech swaps are financial agreements between two parties to exchange cash flows based on a predetermined set of rules. These swaps are typically used to hedge against risks or to speculate on market movements. Think of them like a financial handshake where both parties agree to swap something of value.

Now, the beauty of czech swaps lies in their flexibility. They can be tailored to suit a wide range of needs and can involve various financial instruments such as interest rates, currencies, or commodities. This makes them a versatile tool for both individuals and institutions looking to manage their financial exposure.

Why Czech Swaps Matter

Here’s the deal, czech swaps matter because they offer a way to mitigate risk in an unpredictable market. Whether you’re dealing with fluctuating interest rates or volatile currency exchanges, czech swaps provide a buffer that can protect your investments. Plus, they can also be used to enhance returns by taking advantage of market inefficiencies. It’s like having a financial safety net that also doubles as a profit generator.

History of Czech Swaps

Let’s take a trip down memory lane and explore the origins of czech swaps. Believe it or not, these financial instruments have been around for quite some time. They first emerged in the 1980s as a response to the increasing complexity of global financial markets. Back then, companies were looking for ways to manage their exposure to foreign exchange risks, and czech swaps provided the perfect solution.

Over the years, czech swaps have evolved and become more sophisticated. Advances in technology and the globalization of financial markets have only added to their popularity. Today, they’re a staple in the portfolios of many investors and financial institutions around the world.

Read also:Parents Of Wentworth Miller The Untold Story Of A Hollywood Legacy

Key Milestones in the Evolution of Czech Swaps

- 1980s: The birth of czech swaps as a risk management tool.

- 1990s: Expansion into new asset classes and markets.

- 2000s: Increased use of technology to facilitate trading.

- 2010s: Greater regulation and transparency in the swaps market.

How Czech Swaps Work

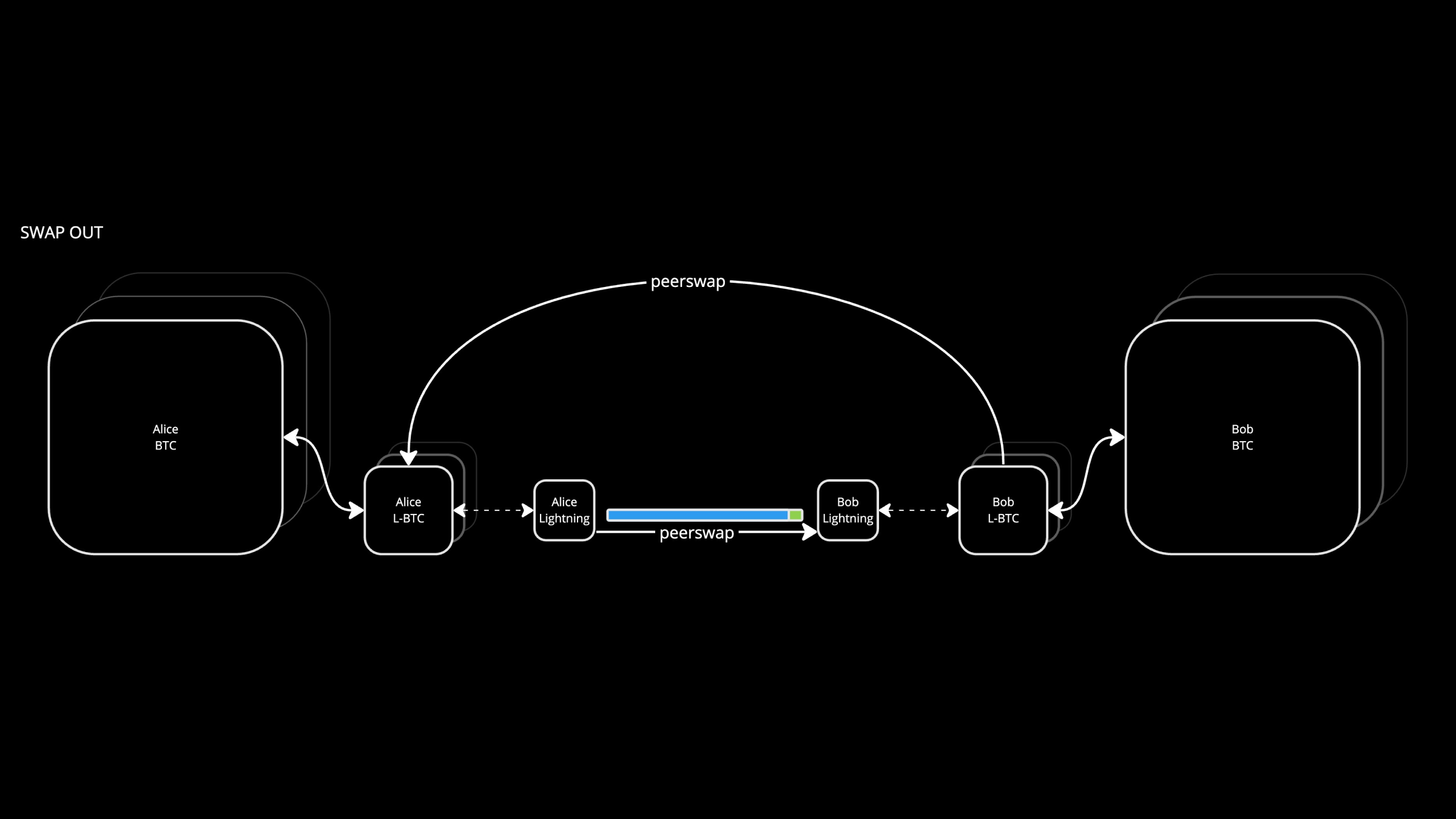

Alright, now that we’ve got the history out of the way, let’s talk about how czech swaps actually work. At its core, a czech swap involves two parties agreeing to exchange cash flows based on a specific set of terms. These terms can include things like the type of swap, the notional amount, the payment frequency, and the benchmark rates.

Here’s a quick breakdown of the process:

- Two parties agree to enter into a czech swap agreement.

- They determine the terms of the swap, including the type of cash flows to be exchanged.

- Payments are made according to the agreed-upon schedule, typically at regular intervals.

- The swap continues until the agreed-upon maturity date, at which point the agreement terminates.

Key Components of a Czech Swap

- Notional Amount: The hypothetical amount used to calculate the cash flows.

- Fixed Rate: The predetermined interest rate used in the swap.

- Floating Rate: The variable rate that fluctuates based on market conditions.

- Payment Frequency: How often the payments are exchanged between parties.

Types of Czech Swaps

Now, not all czech swaps are created equal. There are several different types, each with its own unique characteristics. Let’s take a look at some of the most common ones:

Interest Rate Swaps

These swaps involve exchanging fixed and floating interest rates. They’re often used by companies to manage their interest rate exposure.

Currency Swaps

Currency swaps involve exchanging principal and interest payments in one currency for those in another. This type of swap is popular among multinational corporations looking to hedge against currency fluctuations.

Commodity Swaps

Commodity swaps are used to hedge against price volatility in commodities like oil or gold. They’re a favorite among producers and consumers of these commodities.

Benefits of Czech Swaps

So, why should you consider using czech swaps in your investment strategy? Here are just a few of the benefits:

- Risk Management: They provide a way to hedge against various types of financial risks.

- Flexibility: Czech swaps can be customized to meet specific needs and goals.

- Market Access: They offer access to markets and instruments that might otherwise be difficult to reach.

Risks and Challenges

Of course, like any financial instrument, czech swaps come with their own set of risks and challenges. Some of the key concerns include:

- Counterparty Risk: The risk that the other party in the swap may default on their obligations.

- Market Risk: The risk that market conditions may change in a way that negatively impacts the swap.

- Regulatory Risk: Changes in regulations can affect the legality and enforceability of swaps.

Czech Swaps in Action

Let’s take a look at a real-world example of how czech swaps work in practice. Imagine a company that operates in multiple countries and wants to protect itself against currency fluctuations. They could enter into a currency swap agreement to exchange payments in one currency for those in another. This would allow them to lock in exchange rates and avoid the volatility of the foreign exchange market.

Case Study: Company X

Company X, a global manufacturer, used czech swaps to manage its exposure to interest rate changes. By entering into an interest rate swap, they were able to convert their variable-rate debt into fixed-rate debt, providing stability and predictability in their financial planning.

Legal and Regulatory Aspects

When it comes to czech swaps, it’s important to understand the legal and regulatory landscape. In recent years, there’s been a push for greater transparency and oversight in the swaps market. Regulatory bodies like the SEC and CFTC have implemented rules to ensure that swaps are conducted fairly and responsibly.

Key Regulations to Know

- Dodd-Frank Act: Introduced new requirements for swap dealers and major swap participants.

- EMIR: European regulations aimed at increasing transparency and reducing systemic risk in the derivatives market.

Expert Tips for Success

Alright, here’s the part where we share some insider tips to help you succeed with czech swaps:

- Do Your Research: Understand the market and the specific risks associated with swaps.

- Choose the Right Counterparty: Work with reputable and experienced partners.

- Monitor Market Conditions: Keep an eye on changes that could impact your swaps.

Conclusion

And there you have it, folks, the lowdown on czech swaps. From their origins to their current role in the financial world, we’ve covered a lot of ground. Czech swaps are a powerful tool that can help you manage risk and enhance returns, but they do come with their own set of challenges. The key is to educate yourself and make informed decisions.

So, what’s next? If you’re ready to dive deeper into the world of czech swaps, start by doing your research and consulting with financial experts. And don’t forget to share this article with your friends and colleagues who might benefit from the knowledge. Together, let’s make the financial world a little less intimidating and a lot more rewarding!