Let’s be real, folks. In today’s world, managing your finances can sometimes feel like trying to solve a Rubik’s Cube blindfolded. But don’t sweat it—because understanding how to chase order check books is like having a cheat code for your financial life. Whether you’re a newbie to the banking scene or a seasoned money manager, this guide has got your back. So, buckle up, because we’re diving deep into everything you need to know about ordering checkbooks from Chase Bank.

Now, let’s cut to the chase (pun intended). If you’ve ever wondered how to request a checkbook from Chase or why it matters in the first place, you’re in the right place. This isn’t just another boring article about banking procedures; it’s a roadmap to mastering your money game. Stick around, and by the end, you’ll be a checkbook wizard.

But why are we focusing on Chase? Well, Chase Bank isn’t just any bank—it’s one of the biggest names in the financial world. With millions of customers relying on their services, it makes sense to know the ins and outs of their offerings, especially when it comes to something as essential as checkbooks. So, let’s get started, shall we?

Read also:Bruce Oppenheim The Unsung Hero Of Modern Music Production

What Exactly Is a Chase Order Check Book?

Alright, let’s break it down. A Chase order check book is basically your ticket to making payments the old-school way. Sure, digital transactions are all the rage these days, but there’s still something trustworthy about a good ol’ check. Ordering a checkbook from Chase means you’re equipping yourself with a tool that’s recognized worldwide for making secure payments.

Here’s the deal: Chase offers checkbooks to its customers as part of their checking account services. Whether you need one for personal use or business purposes, Chase has got you covered. Plus, they give you the option to customize your checkbook, which is pretty sweet if you ask me.

Why Should You Care About Chase Checkbooks?

Let’s face it—checks aren’t just for paying rent anymore. They’re still super useful for situations where digital payments aren’t an option. Here are a few reasons why Chase checkbooks matter:

- Security: Checks offer a layer of protection that some digital methods don’t.

- Convenience: Need to pay someone who doesn’t accept cards? A check is your go-to solution.

- Customization: You can personalize your checks to reflect your style or business branding.

- Backup Plan: In case of technical issues with online banking, checks are always there for you.

So, whether you’re paying for a car or sending a gift to a distant relative, having a Chase checkbook in your arsenal is a smart move.

How to Chase Order Check Book: Step-by-Step Guide

Now that we’ve covered the basics, let’s talk about how to actually get your hands on a Chase checkbook. It’s easier than you think, and I’ll walk you through it step by step.

Step 1: Log Into Your Chase Account

The first thing you need to do is log into your Chase online account. If you’re not already set up for online banking, now’s the time to do it. Trust me, it’s a game-changer.

Read also:Is Timothy Olyphant Sick The Truth Behind The Rumors

Step 2: Navigate to the Check Ordering Section

Once you’re logged in, look for the section labeled “Order Checks” or something similar. It’s usually under the “Account Services” tab. Click on it, and you’ll be taken to the check ordering page.

Step 3: Choose Your Checkbook Style

Here’s where things get fun. Chase lets you choose from a variety of checkbook styles. You can go for the classic look or opt for something more personalized. Decide whether you want single checks, duplicate checks, or even business checks if that’s your jam.

Step 4: Confirm Your Order

After selecting your preferred style, double-check all the details to make sure everything’s correct. Once you’re happy, hit the “Order Now” button, and voilà! Your checkbook is on its way.

Common Questions About Chase Checkbooks

Let’s tackle some of the most frequently asked questions about Chase checkbooks. Knowledge is power, right?

How Long Does It Take to Receive My Checkbook?

On average, it takes about 7-10 business days for your checkbook to arrive. But hey, patience is a virtue, and Chase is known for getting things done efficiently.

Can I Customize My Checks?

Absolutely! Chase offers a range of customization options, from adding your business logo to choosing different colors and designs. It’s all about making your checkbook as unique as you are.

What Happens if I Lose My Checkbook?

No worries—Chase has got your back. If you lose your checkbook, simply call their customer service line and report it. They’ll cancel the old one and send you a new one ASAP.

Benefits of Using Chase Checkbooks

Let’s dive into why Chase checkbooks are worth considering for your financial needs.

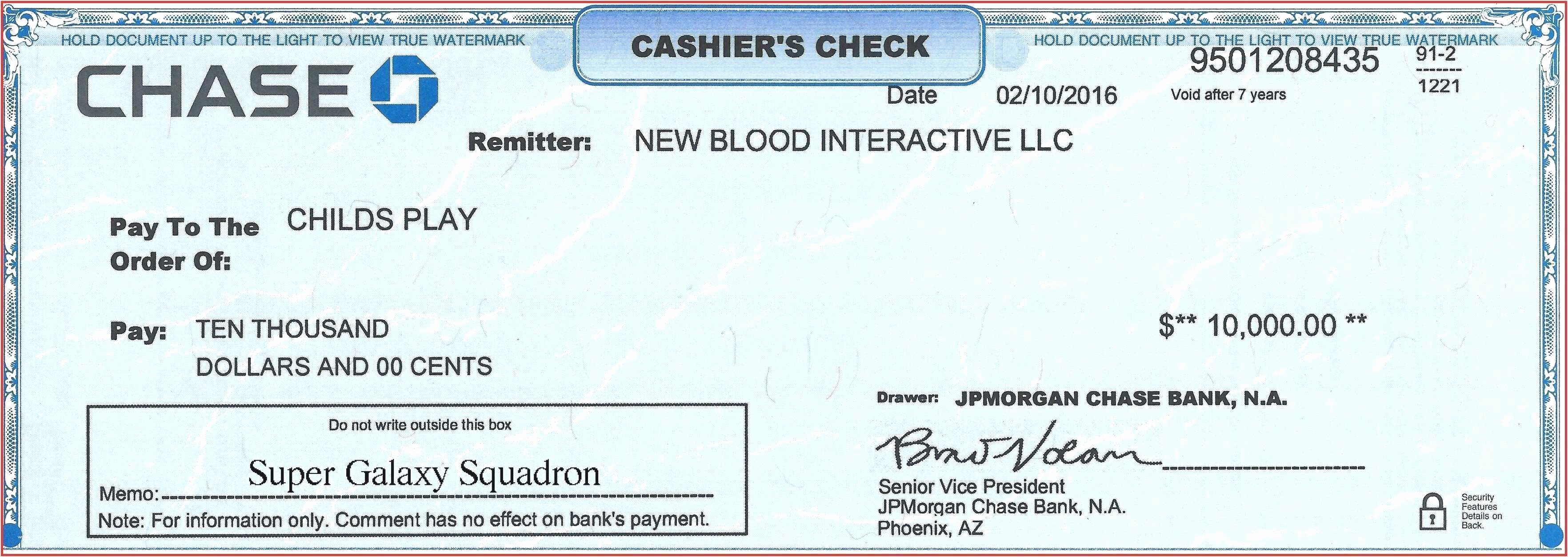

Security Features

Chase checkbooks come with advanced security features to protect you from fraud. From watermarks to special ink, these checks are designed to keep your transactions safe.

Convenience and Flexibility

Whether you’re paying bills, sending gifts, or covering large expenses, Chase checkbooks offer the flexibility you need. Plus, they’re accepted almost everywhere, so you’re covered in most situations.

Customer Support

Chase is known for its excellent customer service. If you ever run into issues with your checkbook, their team is just a phone call away, ready to assist you.

Cost of Chase Checkbooks

Alright, let’s talk money. How much does it cost to order a checkbook from Chase? The good news is that Chase offers free checkbooks to new account holders. After that, the cost varies depending on the style and quantity you choose. Generally, prices range from $15 to $30, but keep an eye out for promotions or discounts.

Are There Any Hidden Fees?

Not really. Chase is pretty transparent about their pricing, so you won’t get hit with any surprise fees. Just make sure you’re aware of the shipping costs if applicable.

Tips for Managing Your Chase Checkbook

Now that you’ve got your checkbook, here are a few tips to help you use it like a pro:

- Keep track of your checks to avoid overdrawing your account.

- Store your checkbook in a safe place to prevent loss or theft.

- Use duplicate checks if you want a record of every transaction.

- Regularly review your bank statements to ensure all checks have cleared properly.

By following these simple tips, you’ll be able to manage your Chase checkbook with ease and confidence.

Alternatives to Chase Checkbooks

While Chase checkbooks are great, it’s always good to know your options. Here are a few alternatives to consider:

Other Banks

Many other banks offer similar checkbook services. Do your research to see if another bank might offer better deals or features.

Third-Party Check Printing Services

If you want more control over the design and features of your checks, consider using a third-party service. Just make sure they’re reputable and offer secure printing.

The Future of Checkbooks

With the rise of digital payments, some people wonder if checkbooks will become obsolete. While it’s true that checks aren’t as common as they used to be, they’re still an essential part of the financial landscape. Chase continues to support checkbook users, recognizing their value in certain transactions.

Will Checks Eventually Disappear?

Probably not anytime soon. While digital methods are gaining popularity, checks remain a reliable and widely accepted payment method. Chase is committed to offering checkbooks as long as there’s demand for them.

Conclusion: Take Control of Your Finances Today

And there you have it, folks—a comprehensive guide to ordering checkbooks from Chase. Whether you’re a first-timer or a seasoned pro, understanding how to manage your Chase checkbook is a key step in taking control of your financial life.

So, what are you waiting for? Head over to your Chase account and order that checkbook. And while you’re at it, don’t forget to share this article with your friends and family. Knowledge is power, and the more people know about managing their finances, the better off we all are.

Call to Action: Leave a comment below and let us know what you think about Chase checkbooks. Do you prefer digital payments, or are you a die-hard check enthusiast? We’d love to hear from you!

Table of Contents

- Chase Order Check Book: The Ultimate Guide to Managing Your Finances Like a Pro

- What Exactly Is a Chase Order Check Book?

- Why Should You Care About Chase Checkbooks?

- How to Chase Order Check Book: Step-by-Step Guide

- Common Questions About Chase Checkbooks

- Benefits of Using Chase Checkbooks

- Cost of Chase Checkbooks

- Tips for Managing Your Chase Checkbook

- Alternatives to Chase Checkbooks

- The Future of Checkbooks