Listen up, folks! If you're here, chances are you've heard about the Chase checkbook and how it can revolutionize the way you handle your money. Whether you're a seasoned finance wizard or just starting out, having the right tools in place is crucial. And let's be honest—Chase checkbooks are not just any old piece of paper. They're a symbol of financial responsibility and organization. So buckle up, because we're diving deep into everything you need to know about Chase checkbooks.

Now, before we get into the nitty-gritty, let's talk about why Chase checkbooks matter. In today's world of digital banking, it's easy to overlook the humble checkbook. But trust me, there's still a place for it, especially if you're dealing with businesses, landlords, or situations where cash isn't an option. A Chase checkbook gives you that extra layer of credibility and security when it comes to transactions.

And hey, let's not forget the convenience factor. With a Chase checkbook, you're not tied to your phone or computer to make payments. You can write a check anytime, anywhere, as long as you've got your trusty checkbook on hand. So, are you ready to learn more? Let's dive in!

Read also:Stevie Wonder Children A Journey Through Music Legacy And Family

What is a Chase Checkbook Anyway?

First things first, let's break down what exactly a Chase checkbook is. Simply put, it's a booklet of pre-printed checks provided by Chase Bank. Each check has your account details, including your name, address, and account number. When you write a check, you're essentially authorizing someone to withdraw a specific amount of money from your account.

But here's the cool part: Chase checkbooks come with some pretty neat features. For starters, they're designed to be secure, with watermarks and other anti-fraud measures in place. Plus, they're easy to order and manage through your Chase account. So whether you're paying rent, settling a bill, or gifting someone money, a Chase checkbook's got you covered.

Why Should You Use a Chase Checkbook?

Let's face it—checks might seem old-school, but they still have their place in the financial world. Here are a few reasons why you should consider using a Chase checkbook:

- Security: Checks offer an extra layer of protection compared to cash. If your check gets lost or stolen, you can cancel it without losing your money.

- Trackability: Every check you write leaves a paper trail, making it easier to keep track of your expenses.

- Professionalism: Checks are often preferred in formal settings, like paying rent or settling large bills.

- Convenience: No need for internet or a smartphone—just grab your checkbook and go!

How to Order a Chase Checkbook

Ordering a Chase checkbook is simpler than you think. All you need is access to your Chase account, either online or via the mobile app. Here's a step-by-step guide to help you out:

- Log in to your Chase account.

- Head over to the "Order Checks" section.

- Select the type of checkbook you want (standard, duplicate, etc.).

- Customize your check design if you'd like.

- Confirm your order and wait for your checkbook to arrive!

Pro tip: If you're in a rush, you can also order checks over the phone by calling Chase's customer service line. Just make sure you have your account details handy!

Tips for Customizing Your Chase Checkbook

Did you know you can personalize your Chase checkbook? From choosing different colors to adding your logo, the options are endless. Here are a few ideas to make your checkbook stand out:

Read also:Bruce Oppenheim The Unsung Hero Of Modern Music Production

- Choose a color scheme that matches your brand or personal style.

- Add a custom message or logo for a professional touch.

- Consider duplicate checks if you want to keep a record of every transaction.

Remember, customizing your checkbook doesn't just make it look good—it can also help you stay organized and professional.

Understanding Chase Check Security Features

Security is a top priority when it comes to financial transactions, and Chase checkbooks are no exception. Here are some of the security features you'll find in your Chase checkbook:

- Watermarks: Each check has a unique watermark that makes it harder to counterfeit.

- Security Ink: The ink used on the checks changes color when exposed to heat or light.

- Microprinting: Tiny text is printed on the checks to prevent fraud.

By incorporating these features, Chase ensures that your checkbook is as secure as possible. So even if your checkbook falls into the wrong hands, the chances of someone forging your checks are slim to none.

Best Practices for Using Your Chase Checkbook

Now that you've got your Chase checkbook in hand, it's time to put it to good use. Here are some best practices to keep in mind:

- Keep Your Checkbook Secure: Store it in a safe place to prevent unauthorized access.

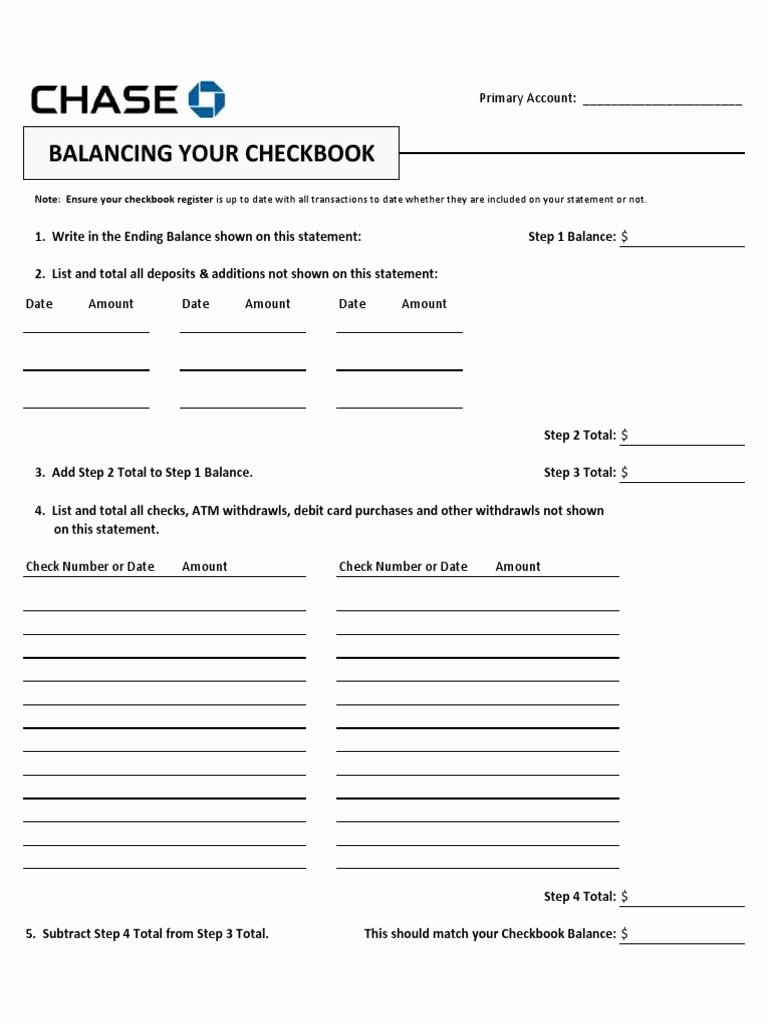

- Record Every Transaction: Use the check register to keep track of all your checks.

- Reconcile Your Account: Regularly compare your checkbook balance with your bank statement to catch any discrepancies.

Following these practices will help you stay on top of your finances and avoid any unpleasant surprises down the line.

Common Questions About Chase Checkbooks

Got questions? We've got answers! Here are some of the most common questions people have about Chase checkbooks:

Can I Order Checks for Free?

While Chase doesn't offer free checks, they do provide affordable options for ordering checkbooks. Plus, if you order duplicate checks, you'll have a built-in record of all your transactions.

How Long Does It Take to Get a Checkbook?

Typically, it takes about 7-10 business days for your checkbook to arrive. If you're in a hurry, you can opt for expedited shipping for an additional fee.

Can I Stop Payment on a Check?

Absolutely! If you lose a check or make a mistake, you can stop payment by contacting Chase customer service. Just be aware that there may be a fee for this service.

Chase Checkbook vs. Digital Payments

In the age of digital banking, you might be wondering whether checkbooks are still relevant. The truth is, both have their pros and cons. Here's a quick comparison:

| Feature | Chase Checkbook | Digital Payments |

|---|---|---|

| Security | High (watermarks, security ink) | Depends on platform |

| Convenience | Requires physical presence | Can be done anywhere |

| Trackability | Paper trail | Digital records |

Ultimately, the choice comes down to your personal preferences and needs. Some people prefer the tangibility of checks, while others love the speed of digital payments.

When Should You Use a Check Instead of Digital Payment?

There are certain situations where checks are still the better option. Here are a few examples:

- Paying rent to landlords who don't accept digital payments.

- Gifting money to someone who doesn't have a bank account.

- Settling large bills or invoices where a paper trail is necessary.

As you can see, checks still have their place in the financial world. It's all about knowing when to use them.

Conclusion: Take Control of Your Finances with Chase Checkbooks

And there you have it—the ultimate guide to Chase checkbooks. From ordering and customizing to using and securing your checkbook, we've covered everything you need to know. Remember, a Chase checkbook isn't just a tool—it's a symbol of financial responsibility and organization.

So what are you waiting for? Head over to your Chase account and order your checkbook today. And don't forget to share this article with your friends and family—knowledge is power, after all!

Got any questions or comments? Drop them below, and let's keep the conversation going. Together, we can take control of our finances and build a brighter future!

Table of Contents

- What is a Chase Checkbook Anyway?

- Why Should You Use a Chase Checkbook?

- How to Order a Chase Checkbook

- Tips for Customizing Your Chase Checkbook

- Understanding Chase Check Security Features

- Best Practices for Using Your Chase Checkbook

- Common Questions About Chase Checkbooks

- Chase Checkbook vs. Digital Payments

- When Should You Use a Check Instead of Digital Payment?

- Conclusion