Let’s face it, folks, when it comes to managing your finances, having the right tools is key. And if you're a Chase Bank customer, one of those essential tools is your Chase Bank checkbook. Whether you're paying bills, settling debts, or just keeping track of your expenses, a checkbook can be an invaluable asset. But let's dive deeper into what makes Chase Bank checkbooks so important and how they can help you stay on top of your financial game.

Nowadays, with all the digital payment methods out there, you might be wondering why you even need a checkbook. Well, here's the thing—checks are still widely accepted for certain transactions, especially when it comes to things like rent payments, utility bills, or even large purchases. Plus, they offer a level of security and traceability that some digital methods don't. So, buckle up, because we're about to break down everything you need to know about Chase Bank checkbooks.

In this guide, we'll cover everything from ordering your first checkbook to understanding how to use it effectively. We'll also throw in some tips and tricks to help you make the most out of your Chase Bank checkbook experience. So, whether you're a seasoned pro or a complete newbie, there's something here for everyone. Let's get started!

Read also:Chase Print Checks Online The Ultimate Guide To Streamline Your Payments

Table of Contents:

- What is a Chase Bank Checkbook?

- Ordering Your First Chase Bank Checkbook

- Why Use a Checkbook?

- How to Order Chase Bank Checkbooks

- Security Features of Chase Bank Checks

- Costs Associated with Chase Bank Checkbooks

- Tips for Using Your Chase Bank Checks

- Common Questions About Chase Bank Checkbooks

- Comparison with Other Banks' Checkbooks

- Final Thoughts

What is a Chase Bank Checkbook?

Alright, let’s start with the basics. A Chase Bank checkbook is essentially a booklet containing pre-printed checks that are linked to your Chase Bank account. These checks allow you to make payments by writing out the amount, the payee’s name, and signing the check. It's like having a physical way to transfer money from your account to someone else's. Simple, right?

But here's the kicker—Chase Bank checkbooks come with several security features to protect both you and the bank from fraud. We'll dive deeper into those later, but for now, just know that these checkbooks are designed to keep your transactions safe and secure.

Oh, and before we move on, let me just throw this out there: Chase Bank checkbooks are customizable! You can choose from different designs, layouts, and even add your personal info to make them uniquely yours. It’s like putting your own stamp on your finances.

Why Chase Bank Checkbooks Stand Out

Now, you might be thinking, "Why should I choose Chase Bank checkbooks over other banks?" Great question! Chase Bank has been around for a long time and has built a reputation for reliability and customer service. Their checkbooks are no exception. With features like fraud protection, easy ordering, and customization options, Chase Bank checkbooks are a solid choice for anyone looking to manage their finances effectively.

Ordering Your First Chase Bank Checkbook

So, you've decided to get a Chase Bank checkbook, but where do you start? Ordering your first checkbook is actually pretty straightforward. You can do it either online through your Chase Bank account or by visiting a local branch. Let me walk you through both methods.

Read also:November 1 Zodiac Sign Discover The Traits And Secrets Of Scorpio

Ordering Online

First things first, log in to your Chase Bank account. Once you're in, navigate to the "Order Checks" section. From there, you'll be able to choose the type of checkbook you want, select any customization options, and place your order. Easy peasy lemon squeezy, right?

Ordering at a Branch

If you're more of a hands-on kind of person, you can always visit a Chase Bank branch. Just bring your ID and your account information, and one of the friendly associates will help you place your order. Plus, you'll get to see some of the design options in person, which can be pretty cool.

And here's a pro tip: If you're ordering your first checkbook, it might be a good idea to go to a branch. That way, you can get some face-to-face guidance and make sure you're getting exactly what you need.

Why Use a Checkbook?

Alright, let's talk about why you should even bother with a checkbook in this digital age. Sure, there are plenty of apps and online platforms that let you make payments, but checks still have their place. Here are a few reasons why:

- Security: Checks provide a paper trail that can be helpful in case of disputes or fraud.

- Acceptance: Many landlords, utility companies, and businesses still prefer checks over other payment methods.

- Control: Writing a check gives you more control over when the payment is processed compared to some digital methods.

Plus, let's not forget that checks can be a great backup option in case your digital payment methods aren't working. You never know when you'll need that extra layer of financial flexibility.

How to Order Chase Bank Checkbooks

Now that we've covered the basics, let's dive into the nitty-gritty of ordering Chase Bank checkbooks. Whether you're ordering your first one or just need a refill, the process is pretty much the same.

Step-by-Step Guide

Here's a quick step-by-step guide to help you order your Chase Bank checkbooks:

- Log in to your Chase Bank account.

- Go to the "Order Checks" section.

- Select the type of checkbook you want (personal, business, etc.).

- Choose any customization options.

- Review your order and submit it.

And just like that, you're done! Your new checkbook will usually arrive in 7-10 business days, but if you're in a hurry, you can always opt for expedited shipping for a small fee.

Things to Keep in Mind

While ordering your checkbook, there are a few things you should keep in mind:

- Make sure your account info is up-to-date.

- Double-check your customization options to avoid any mistakes.

- Consider ordering extra checks if you think you'll need them.

Trust me, it's always better to be safe than sorry when it comes to your finances.

Security Features of Chase Bank Checks

Now, let's talk about one of the most important aspects of Chase Bank checkbooks—security. In today's world, where fraud is always a concern, it's crucial to know that your checks are protected. Here are some of the security features that come with Chase Bank checks:

- Watermarks: Each check has a unique watermark that makes it harder to counterfeit.

- Security Ink: The ink used on the checks changes color when exposed to certain chemicals, making it easier to spot fake checks.

- Microprinting: Tiny text that's difficult to replicate without specialized equipment.

These features are just a few examples of how Chase Bank ensures the safety of your transactions. And if you ever suspect fraud, you can always contact Chase Bank's fraud department for assistance.

Costs Associated with Chase Bank Checkbooks

Of course, no discussion about checkbooks would be complete without talking about costs. So, how much does it cost to order a Chase Bank checkbook? Well, it depends on a few factors, such as the type of checkbook you're ordering and any customization options you choose.

Standard Checkbook Costs

For most customers, a standard checkbook will cost around $20-$30. If you opt for a more premium design or add extra features, the price can go up. But don't worry, Chase Bank often runs promotions and discounts, so keep an eye out for those.

Additional Fees

There are a few additional fees you should be aware of:

- Expedited Shipping: If you need your checkbook fast, you can pay a small fee for expedited shipping.

- Customization Fees: Adding things like logos or special designs can increase the cost of your checkbook.

But hey, at the end of the day, the cost of a checkbook is pretty minimal compared to the peace of mind it provides.

Tips for Using Your Chase Bank Checks

Now that you've got your Chase Bank checkbook, it's time to put it to use. But before you start writing checks left and right, here are a few tips to help you use them effectively:

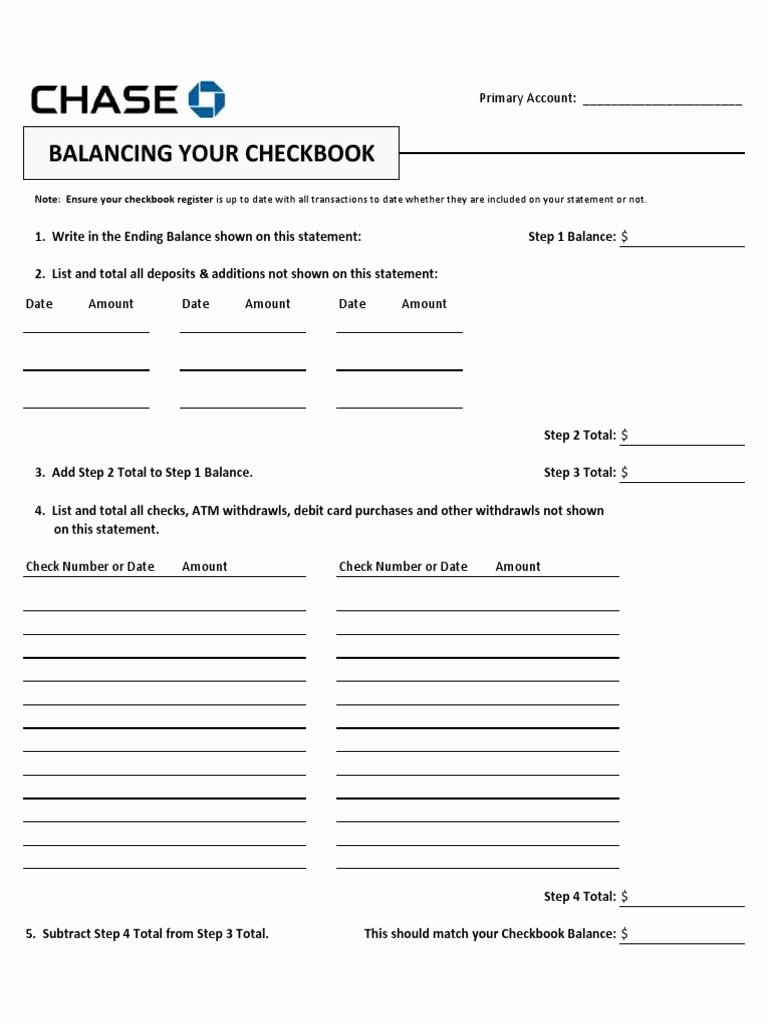

- Keep Track of Your Checks: Always record each check you write in your check register to avoid any surprises later.

- Double-Check Your Work: Make sure you've written the correct amount and payee name before signing the check.

- Secure Your Checkbook: Don't leave your checkbook lying around where someone else can get their hands on it.

These tips might seem simple, but they can save you a lot of headaches down the road.

Common Questions About Chase Bank Checkbooks

Got any burning questions about Chase Bank checkbooks? Don't worry, we've got you covered. Here are some of the most common questions people ask:

- How long does it take to receive my checkbook? Usually 7-10 business days, but expedited shipping is available.

- Can I customize my checkbook? Absolutely! You can choose from a variety of designs and add your personal info.

- What should I do if I suspect fraud? Contact Chase Bank's fraud department immediately.

And if you have any other questions, don't hesitate to reach out to Chase Bank's customer service team. They're there to help!

Comparison with Other Banks' Checkbooks

So, how do Chase Bank checkbooks stack up against the competition? Well, Chase Bank is known for its reliability, security features, and customer service. While other banks might offer similar products, Chase Bank's reputation for excellence sets it apart.

Plus, with Chase Bank's extensive network of branches and ATMs, you can always find help when you need it. So, if you're looking for a checkbook that's both secure and convenient, Chase Bank is definitely worth considering.

Final Thoughts

Well, there you have it, folks! Everything you need to know about Chase Bank checkbooks. From ordering your first checkbook to understanding the security features and costs, we've covered it all. Remember, a checkbook is more than just a tool—it's a way to take control of your finances and ensure that your transactions are safe and secure.

So, if you're a Chase Bank customer and haven't ordered your checkbook yet, what are you waiting for? Get out there and take the first step towards financial peace of mind. And if you found this guide helpful, don't forget to share it with your friends and family. Who knows, you might just help them out too!

Until next time, stay safe, stay smart, and keep those finances in check!