So here we are, diving straight into the question that’s been buzzing around your mind: can I get a checkbook from Chase? If you’ve ever found yourself scratching your head over this one, you’re not alone. Plenty of folks are curious about whether Chase offers checkbooks and how to go about getting one. Let’s break it down for you, nice and simple, so you can walk away with all the info you need. No more guessing games, just straight-up answers.

Checkbooks might seem like a relic from the past in this digital age, but they’re still pretty handy for certain transactions. Whether you’re paying rent, sending money to family, or covering expenses that don’t accept cards, having a checkbook can be a lifesaver. And if Chase is your bank of choice, it’s good to know what options you have when it comes to ordering checks. Stick around, because we’re about to spill all the tea.

Before we dive into the nitty-gritty, let’s clear the air: Chase does indeed offer checkbooks to its customers. But there’s more to it than just walking into a branch and grabbing one. There are steps to follow, formats to choose from, and even some cool perks that come with being a Chase customer. By the end of this article, you’ll be an expert on all things checkbooks at Chase. Sound good? Let’s go!

Read also:Is Lilith Berry Ai Unveiling The Truth Behind The Digital Phenomenon

Why Chase for Your Banking Needs

Let’s face it, when it comes to banking, Chase is a big player in the game. With thousands of branches across the US, Chase offers a wide range of services that cater to both personal and business needs. Whether you’re managing your everyday expenses or saving up for a dream vacation, Chase has got your back. But why should you choose Chase over other banks? Here are a few reasons:

- Extensive branch and ATM network

- Top-notch mobile banking features

- Competitive interest rates on savings accounts

- Customer support that’s available 24/7

- Flexible account options for different lifestyles

When you bank with Chase, you’re not just signing up for an account—you’re gaining access to a suite of tools and resources designed to make your financial life easier. And when it comes to checkbooks, Chase makes the process as seamless as possible. So if you’re already a Chase customer, getting a checkbook is just another perk of the package.

Understanding Checkbooks in the Digital Age

Alright, let’s talk checkbooks. In a world where everything seems to be going digital, checkbooks might feel a bit old-school. But don’t underestimate their power! Even in 2023, checks are still widely accepted for various transactions, especially for things like rent payments, utility bills, and large purchases. Plus, they’re a great backup option if your card gets declined or if you’re dealing with someone who doesn’t accept digital payments.

But here’s the thing: not all banks make it easy to order checkbooks. Some charge ridiculous fees, while others make you jump through hoops just to get your hands on one. That’s where Chase shines. Chase customers can order checkbooks directly through their online portal or by visiting a branch, and the process is super straightforward. No hidden fees, no complicated forms—just simple, hassle-free service.

Can I Get a Checkbook from Chase? The Short Answer

Yes, you can absolutely get a checkbook from Chase! Chase offers checkbooks to its customers as part of their standard services. Whether you have a basic checking account or a premium account, you’re eligible to order checks. The best part? Chase partners with trusted check printing companies to ensure that your checkbook is secure, professional, and ready to use whenever you need it.

And here’s a bonus tip: Chase allows you to personalize your checkbook with your name, address, and even a custom design if you want to add a touch of personality. It’s all about making your banking experience as convenient and enjoyable as possible.

Read also:Mike Ross Height Unveiling The Truth Behind The Suits Legend

How to Order a Checkbook from Chase

Now that we’ve established that Chase does offer checkbooks, let’s talk about how you can actually get one. The process is surprisingly easy, and you have a couple of options to choose from. Whether you prefer doing things online or you’d rather visit a branch in person, Chase has got you covered. Here’s a step-by-step guide:

Option 1: Ordering Online

Ordering a checkbook online is probably the most convenient way to go. Here’s how you can do it:

- Log in to your Chase account through the mobile app or website

- Go to the “Order Checks” section

- Choose the type of checkbook you want (personal, business, etc.)

- Select any customization options you’d like

- Confirm your order and wait for your checkbook to arrive

It’s as simple as that! Chase will send your checkbook to the address on file, usually within a week or two. And don’t worry—your checkbook will come with security features to protect against fraud.

Option 2: Visiting a Branch

If you’re more of a hands-on person, you can always visit a Chase branch to order your checkbook in person. Here’s what you need to do:

- Find your nearest Chase branch using the Chase locator tool

- Bring your ID and account information with you

- Speak to a representative about ordering a checkbook

- Choose your checkbook options and confirm your order

Visiting a branch can be a good option if you have questions or need help with the process. Chase representatives are trained to assist you every step of the way, so you won’t feel lost or confused.

Types of Checkbooks Available at Chase

Not all checkbooks are created equal, and Chase understands that different customers have different needs. That’s why they offer a variety of checkbook options to suit your preferences. Here’s a breakdown of what you can expect:

- Personal Checks: Perfect for everyday use, these checks come with your name and address pre-printed.

- Business Checks: Ideal for business owners, these checks often include additional security features and branding options.

- Traveler’s Checks: Great for international travel, these checks can be used as an alternative to cash when abroad.

- Customizable Checks: Add a personal touch to your checkbook with custom designs, logos, or colors.

No matter which type of checkbook you choose, Chase ensures that it meets the highest standards of security and quality. You can rest easy knowing that your checks are protected against fraud and unauthorized use.

Cost of Checkbooks at Chase

One of the most common questions people have is about the cost of checkbooks. The good news is that Chase doesn’t charge exorbitant fees for checkbooks. In fact, many of their checkbook options are quite affordable, especially when compared to other banks. Here’s what you can expect:

For basic personal checks, you might pay around $15-$25 per book, depending on the quantity and customization options you choose. Business checks and traveler’s checks may be slightly more expensive, but Chase offers discounts for bulk orders. And if you’re a Chase Premier customer, you might even qualify for free checkbooks as part of your membership perks.

Remember, these prices are subject to change, so it’s always a good idea to check with Chase directly for the most up-to-date information.

Tips for Using Your Checkbook Wisely

Now that you know how to get a checkbook from Chase, let’s talk about how to use it wisely. Checks can be a powerful financial tool, but only if you use them responsibly. Here are a few tips to keep in mind:

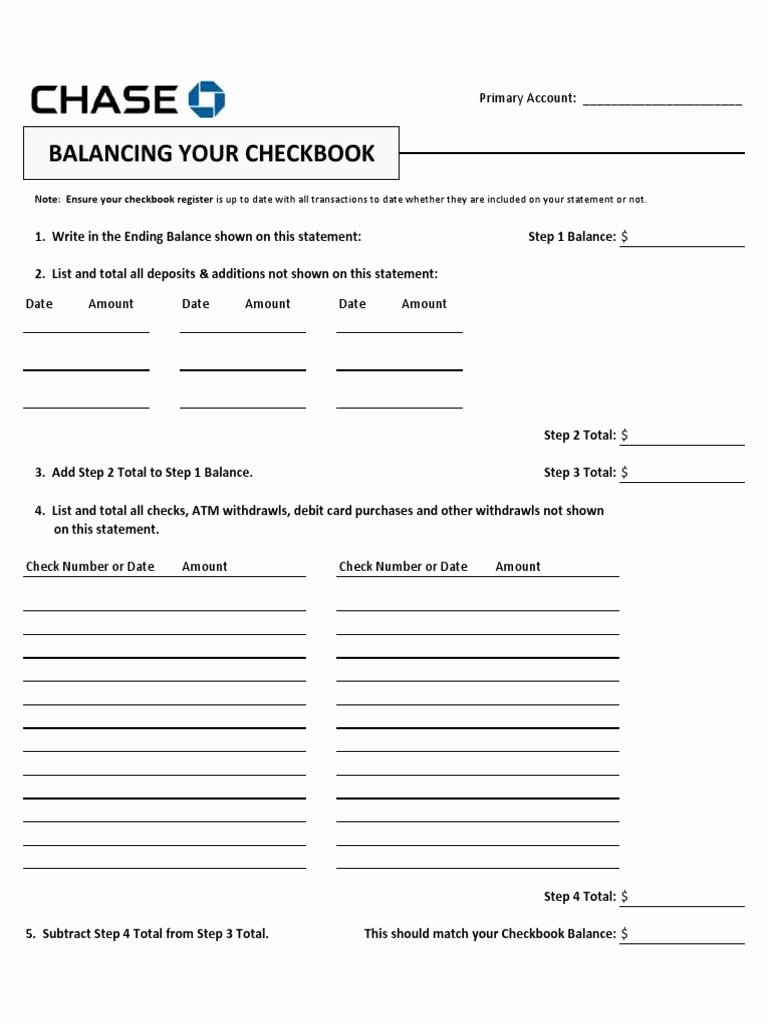

- Keep Track of Your Checks: Always record the checks you write in your check register to avoid overdraft fees.

- Secure Your Checkbook: Don’t leave your checkbook lying around—store it in a safe place to prevent unauthorized use.

- Verify Recipients: Make sure the person or business you’re writing a check to is legitimate to avoid scams.

- Monitor Your Account: Regularly check your account for any discrepancies or unauthorized transactions.

By following these tips, you can ensure that your checkbook is a valuable asset rather than a potential liability.

Common Questions About Chase Checkbooks

Let’s address some of the most common questions people have about checkbooks at Chase:

1. How long does it take to receive my checkbook?

Typically, it takes about 7-10 business days for your checkbook to arrive after placing your order. However, this timeframe can vary depending on your location and the shipping method used.

2. Can I reorder checks if I run out?

Absolutely! You can reorder checks as many times as you need. Simply follow the same process you used to order your first checkbook, and you’ll be all set.

3. Are Chase checks secure?

Yes, Chase checks come with advanced security features to protect against fraud. These include watermarks, security ink, and microprinting.

4. Can I cancel a check if it gets lost?

If you lose a check or it gets stolen, you can contact Chase to stop payment on it. Be sure to act quickly to prevent any unauthorized use.

Conclusion: Can I Get a Checkbook from Chase?

Well, there you have it! The answer to the burning question, can I get a checkbook from Chase?, is a resounding yes. Chase makes it easy for customers to order checkbooks, whether you prefer doing it online or in person. With a variety of options to choose from and affordable pricing, Chase checkbooks are a great addition to your financial toolkit.

Remember, using a checkbook responsibly is key to avoiding any headaches down the road. Keep track of your checks, store your checkbook safely, and monitor your account regularly. And if you ever have questions or need assistance, Chase’s customer support team is just a phone call away.

So what are you waiting for? Go ahead and order your checkbook today. And while you’re at it, don’t forget to share this article with your friends and family who might find it useful. Together, let’s make banking easier and more accessible for everyone!

Table of Contents:

- Why Chase for Your Banking Needs

- Understanding Checkbooks in the Digital Age

- Can I Get a Checkbook from Chase? The Short Answer

- How to Order a Checkbook from Chase

- Types of Checkbooks Available at Chase

- Cost of Checkbooks at Chase

- Tips for Using Your Checkbook Wisely

- Common Questions About Chase Checkbooks

- Conclusion: Can I Get a Checkbook from Chase?