Let me tell you something, folks. If you've ever wondered what the big deal is about a chase cheque book, you're not alone. It's like this little financial tool that holds more power than you'd think. Picture this: you're sitting at your favorite café, sipping on your latte, and someone hands you a cheque book. You might think, "What am I supposed to do with this?" Well, let me break it down for you. A chase cheque book is your key to managing payments, tracking expenses, and keeping your financial life in check. It’s like your personal finance superhero in a little booklet form.

Now, before we dive deep into the world of cheque books, let’s talk about why they still matter in today’s digital age. Sure, we’ve got Venmo, Zelle, PayPal, and all those fancy apps, but there’s something about the reliability of a good old-fashioned cheque. It's like the OG of payment methods. Whether you're paying rent, sending money to family, or settling bills, a chase cheque book has got your back. So, stick around because we’re about to uncover everything you need to know about it.

And hey, if you're thinking, "Do people even use cheque books anymore?" The answer is yes, they absolutely do. Businesses, landlords, and even some individuals still rely on cheques for payments. It’s not just about convenience; it’s also about security and traceability. So, whether you're new to the world of banking or just curious about how a chase cheque book works, this guide is here to help you out.

Read also:Smash Oslo Position The Ultimate Guide For Trading Success

Table of Contents

- What is a Chase Cheque Book?

- How to Order a Chase Cheque Book

- Understanding the Components of a Cheque

- Benefits of Using a Chase Cheque Book

- Common Questions About Chase Cheque Books

- Security Features of Chase Cheques

- Alternatives to Chase Cheque Books

- How to Use a Chase Cheque

- Tracking Your Cheques

- Conclusion

What is a Chase Cheque Book?

Alright, let’s get down to business. A chase cheque book is essentially a collection of pre-printed cheques provided by Chase Bank. These cheques are your ticket to making payments the old-school way. Each cheque contains critical information, such as your account details, the bank’s routing number, and a unique cheque number. It’s like your personalized financial tool that helps you transfer money securely and efficiently.

But here’s the kicker: a chase cheque book isn’t just any booklet. It’s a trusted method that businesses and individuals have relied on for decades. Whether you’re paying for a big purchase or settling a debt, a cheque book gives you the flexibility to make payments without needing an internet connection or a smartphone app.

Now, let’s not forget the importance of understanding what makes a chase cheque book different from other banking tools. Unlike debit cards or online transfers, cheques provide a paper trail. This means every transaction you make is documented, which can be super helpful if there’s ever a dispute or issue with a payment.

Why Choose Chase for Your Cheque Book?

When it comes to banking, Chase is one of the biggest names in the game. They’ve been around for over 200 years, so you know they’ve got their stuff together. A chase cheque book comes with the assurance of a reputable bank, meaning your payments are handled with care and security. Plus, Chase offers a range of services that complement your cheque book, like mobile banking and online account management.

Think of it this way: when you choose Chase, you’re not just getting a cheque book; you’re getting access to a whole suite of financial tools that make managing your money easier. So, whether you’re a small business owner or just someone trying to keep their finances in order, Chase has got your back.

How to Order a Chase Cheque Book

Ordering a chase cheque book is easier than you might think. First things first, you’ll need to have a Chase checking account. Once you’ve got that sorted, you can order your cheque book through Chase’s online portal or by visiting one of their branches. It’s like ordering takeout, but instead of food, you’re getting a financial tool.

Read also:Eve Kretz Age Unveiling The Life And Journey Of A Rising Star

Here’s a quick step-by-step guide:

- Log in to your Chase account online or via the mobile app.

- Head over to the "Order Cheques" section.

- Select the type of cheque book you want (personal or business).

- Customize your cheques if you want to add a personal touch.

- Submit your order and wait for your cheque book to arrive in the mail.

And just like that, you’ve got yourself a shiny new chase cheque book. It’s that simple. Oh, and by the way, Chase usually covers the cost of your first cheque book, so there’s no need to worry about extra fees.

Tips for Ordering Your First Chase Cheque Book

If you’re new to the cheque game, here are a few tips to keep in mind:

- Choose a design that suits your style. Chase offers a variety of options, from classic to modern.

- Consider ordering extra cheques if you think you’ll need them. It’s always better to be prepared.

- Keep your cheque book in a safe place. You wouldn’t leave your wallet lying around, right? Treat your cheque book the same way.

Ordering a chase cheque book is just the beginning. Once you’ve got it in hand, you’ll unlock a whole new way of managing your finances.

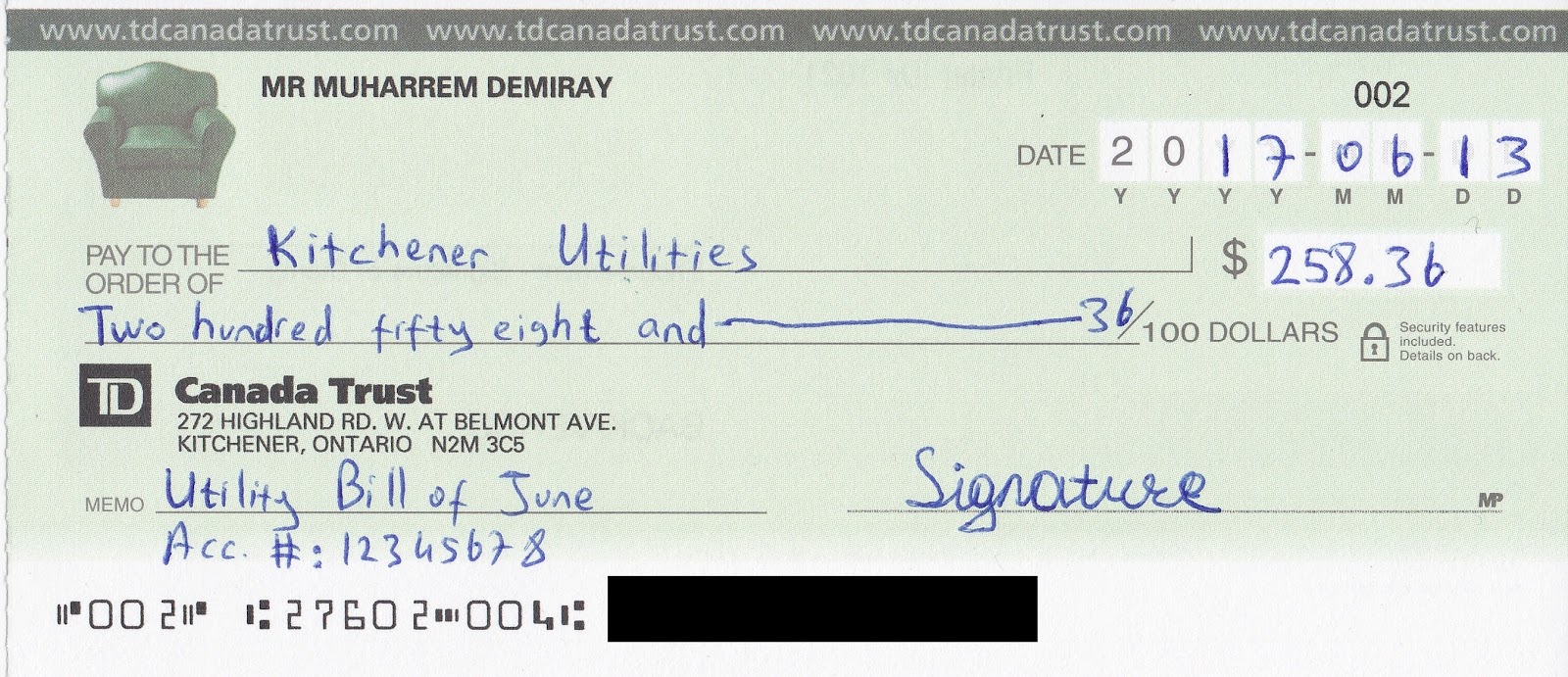

Understanding the Components of a Cheque

Now that you’ve got your chase cheque book, it’s time to learn what makes a cheque tick. Each cheque is packed with important information that ensures your payment is processed correctly. Here’s a breakdown of the key components:

- Payee Line: This is where you write the name of the person or business you’re paying.

- Amount Box: Enter the payment amount in numbers here.

- Amount Line: Write the payment amount in words to confirm the amount.

- Date Line: Fill in the date of the transaction.

- Signature Line: Sign your cheque here to authorize the payment.

- Memorandum Line: Use this space to add a note or reference number if needed.

Each of these components plays a crucial role in ensuring your cheque is processed without a hitch. So, take a moment to familiarize yourself with them before you start writing cheques.

Common Mistakes to Avoid When Filling Out a Cheque

Let’s face it, we’ve all made mistakes when filling out a cheque. But here’s the thing: those mistakes can cost you. Here are a few common errors to watch out for:

- Forgetting to sign the cheque. Without your signature, the cheque is invalid.

- Writing the amount incorrectly. Double-check the numbers and words to make sure they match.

- Leaving blank spaces. Always draw a line through any unused space to prevent alterations.

By avoiding these mistakes, you’ll ensure your cheques are processed smoothly and securely.

Benefits of Using a Chase Cheque Book

So, why should you use a chase cheque book in the first place? Well, there are plenty of reasons. For starters, cheques offer a level of security that other payment methods can’t match. Unlike cash, which can be lost or stolen, a cheque provides a paper trail that can be traced if something goes wrong.

Here are a few more benefits:

- Convenience: You can write a cheque anytime, anywhere, without needing an internet connection.

- Flexibility: Cheques can be used for a wide range of payments, from rent to utility bills.

- Security: Each cheque is unique and can be canceled if it’s lost or stolen.

- Traceability: Every cheque you write is recorded in your bank statement, making it easy to track your payments.

These benefits make a chase cheque book a valuable tool for managing your finances. Whether you’re a small business owner or just someone trying to stay organized, a cheque book can help you keep everything in order.

Common Questions About Chase Cheque Books

Let’s tackle some of the most common questions people have about chase cheque books. Chances are, if you’re wondering about something, someone else has asked the same question.

How Long Does It Take to Receive a Chase Cheque Book?

Once you’ve ordered your chase cheque book, it typically takes 7-10 business days to arrive. If you’re in a rush, you can visit a Chase branch and get a temporary cheque book on the spot.

Can I Customize My Chase Cheque Book?

Absolutely! Chase offers a range of customization options, from choosing your cheque design to adding your personal information. You can even add a logo or image to make your cheques stand out.

What Happens If I Lose My Chase Cheque Book?

If you lose your chase cheque book, don’t panic. Contact Chase immediately to report it as lost or stolen. They’ll cancel the cheques and issue you a new booklet. It’s like having a backup plan for your backup plan.

Security Features of Chase Cheques

Security is a top priority when it comes to chase cheque books. Chase employs several features to ensure your cheques are protected:

- Watermarks: Each cheque has a unique watermark that makes it difficult to counterfeit.

- Security Ink: The ink used on Chase cheques changes color when exposed to certain chemicals.

- Microprinting: Tiny text is printed on the cheque to prevent alterations.

These features make it nearly impossible for someone to forge or alter your cheques. So, you can rest easy knowing your payments are secure.

Alternatives to Chase Cheque Books

While chase cheque books are a great option, they’re not the only game in town. Here are a few alternatives to consider:

- Online Banking: Many people prefer the convenience of online transfers and payments.

- Debit Cards: These offer instant access to your funds and can be used almost anywhere.

- Mobile Payment Apps: Apps like Venmo and Zelle make it easy to send and receive money.

That said, there’s something about a chase cheque book that just can’t be beat. It’s reliable, secure, and offers a level of control that digital methods sometimes lack.

How to Use a Chase Cheque

Using a chase cheque is pretty straightforward. Here’s how it works:

- Fill in the payee’s name on the payee line.

- Enter the payment amount in the amount box.